In recent years, the proliferation of mobile loan apps has revolutionized access to credit for many people in Tanzania. PesaX is one such app that has gained popularity among Tanzanian users seeking quick and convenient access to loans. In this article, we will explore the user reputation of the PesaX loan app in Tanzania, providing a comprehensive overview of its features, user experiences, and the overall impact it has had on the lending landscape in the country.

Overview of PesaX Loan App

PesaX is a mobile loan app that provides instant loans to users in Tanzania. The app offers a seamless and user-friendly interface, allowing individuals to apply for loans, track their repayments, and access customer support directly from their mobile devices. With a focus on speed and convenience, PesaX has positioned itself as a viable alternative to traditional banking institutions for individuals in need of quick financial assistance.

User Experiences and Reviews

The user reputation of PesaX in Tanzania is a mixed bag, with both positive and negative reviews contributing to its overall standing in the market. Many users have lauded the app for its easy application process, quick approval times, and transparent fee structures. Additionally, the accessibility of the app has been praised, particularly by individuals in remote or underserved areas who may have limited access to traditional banking services.

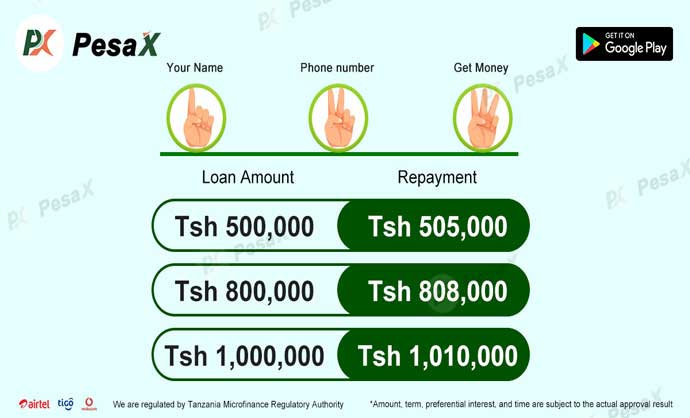

However, some users have expressed concerns about the high interest rates associated with PesaX loans, citing them as a potential barrier to responsible borrowing. Additionally, there have been reports of aggressive debt collection practices by the app, leading to dissatisfaction among certain borrowers. These negative experiences have undoubtedly impacted the overall reputation of PesaX among Tanzanian users.

Impact on Lending Landscape

Despite the mixed user reputation, PesaX has undeniably made a significant impact on the lending landscape in Tanzania. By leveraging technology and data-driven algorithms, the app has been able to reach segments of the population that were previously underserved by traditional financial institutions. This has contributed to greater financial inclusion and provided individuals with the means to meet their short-term financial needs.

Furthermore, the success of PesaX has prompted increased competition in the mobile lending sector, leading to innovations in product offerings and customer service. As a result, Tanzanian consumers now have a wider array of options when it comes to accessing credit, ultimately driving improvements in the overall quality of financial services available to them.

In conclusion, the user reputation of the PesaX loan app in Tanzania reflects a combination of positive and negative experiences. While the app has undoubtedly filled a critical gap in the lending landscape by providing quick and accessible credit to underserved populations, it is also important for users to exercise caution and fully understand the terms and conditions associated with borrowing through the app. As the mobile lending sector continues to evolve, it is essential for providers like PesaX to prioritize responsible lending practices and ensure positive user experiences for all borrowers.