In Kenya, with the proliferation of mobile technology, loan apps have become a key tool for many people to solve their urgent financial needs and realize their dreams. This article will explore the top three loan apps in Kenya, focusing on one of them, Fairkash+, and reveal how this app changes people’s financial experience and provides them with convenience and opportunities.

I. Loan app trends in Kenya

Kenya’s fintech scene is growing rapidly, with mobile lending apps becoming an increasingly common financial tool among locals. The rise of these apps has been fueled by the proliferation of smartphones and demand for more convenient and faster ways to borrow money. In Kenya, three loan apps stand out for providing users with fast and convenient loan services.

II. Top three loan applications in Kenya

1.Fairkash+:

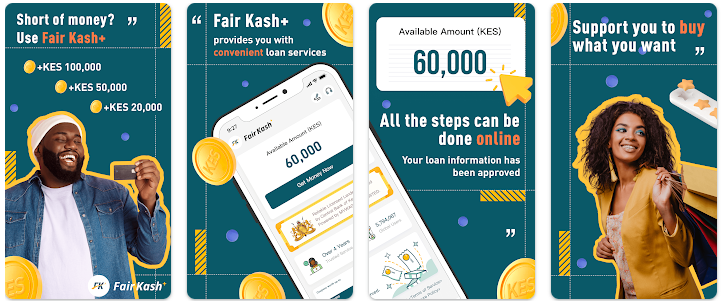

Fairkash+ is a popular loan app that provides users with personalized loan packages. The app analyzes users’ mobile phone data to understand their credit history and preferences to determine loan amounts and interest rates. Loan approvals at Fairkash+ are very fast, allowing users to quickly access the funds they need in emergencies.

2.M-Pesa:

M-Pesa is not just a mobile payment app in Kenya, it is also one of the most popular loan apps in the country. M-Pesa’s loan services are provided through its large user network, and users can easily apply for loans and repay them. The app assesses credit risk based on a user’s payment history and usage patterns, making the loan application process more streamlined and efficient.

3.Tala:

Tala, another popular lending app in Kenya, uses users’ mobile phone usage data to assess credit risk. Tala provides small loans, especially for those who need short-term financial support. The app focuses on users’ financial education and helps users better manage their finances by providing advice on loan usage and repayment.

III. Fairkash+: The leading lending application

Among the top three loan apps in Kenya, Fairkash+ stands alone. As a leading loan service provider, Fairkash+ has earned the trust of its users for its excellent customer service, flexible loan products and efficient loan processing processes. The loan products provided by this application cover various purposes such as personal loans and business loans. Users can choose a suitable loan plan according to their own needs. Fairkash+ focuses on users’ credit history, while also providing opportunities for those who lack credit history to help them build credit.

IV. Advantages of Fairkash+

Fairkash+ stands out from the competition in the Kenyan loan application market. Its advantages are mainly reflected in the following aspects:

Comprehensive Product Range: Fairkash+ offers a variety of loan products catering to the needs of different users, including personal loans, business loans, emergency loans, etc.

Efficient processing flow: The application uses fast approval and rapid release of funds to help users quickly resolve financial needs and adapt to emergencies.

Intimate customer service: Fairkash+ is customer-centric and provides a professional customer service team to answer users’ questions and provide loan suggestions to ensure that users are supported throughout the entire loan process.

Credit-building opportunities: For those users who lack credit history, Fairkash+ provides opportunities to build credit, helping them integrate into the financial system and enjoy more financial services.

V. Conclusion

In Kenya’s loan application market, Fairkash+ provides users with convenient and reliable loan solutions with its excellent services and innovative products. Whether an individual is in desperate need of capital or a business is looking to expand, Fairkash+ provides users with the support and opportunities to drive financial inclusion and economic growth in Kenya. Through its continued innovation and commitment, Fairkash+ is more than just a lending app, it is a leader in Kenya’s fintech industry, opening up new possibilities for future financial services.