Kenya’s personal lending environment has grown rapidly over the past few years and has been a leader in digital finance. Mobile payment services such as M-Pesa have become the main method of payments and loans in the country. This digital payments ecosystem provides numerous opportunities for fintech companies to provide personal loans and credit services.

Kenya’s personal loan market has benefited from the rise of various mobile lending apps. These apps provide individuals with a convenient way to obtain short-term loans, often without the need for collateral. Loan amounts are usually smaller and are suitable for emergency spending and short-term financial needs.

The loan market in Kenya is very competitive, which is good for borrowers. This means that different loan providers are trying to offer more attractive loan terms, including lower interest rates, longer repayment terms and higher loan limits.

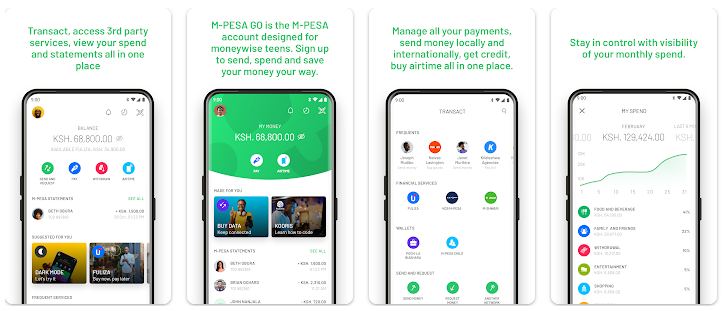

1.M-Pesa:

M-Pesa, operated by Safaricom, is one of the most popular mobile money services in Kenya. While it’s primarily known for facilitating mobile payments, it also offers a mobile lending service called “Fuliza” and “M-Shwari.” Users can access short-term loans through these services, and the loan limits are determined based on the user’s transaction history and creditworthiness.

Pros:

Convenient as it’s integrated with the M-Pesa wallet.

Accessible to a large number of Kenyans.

Relatively low interest rates.

Cons:

Loan amounts might be limited for new users.

Users need to have an active M-Pesa account.

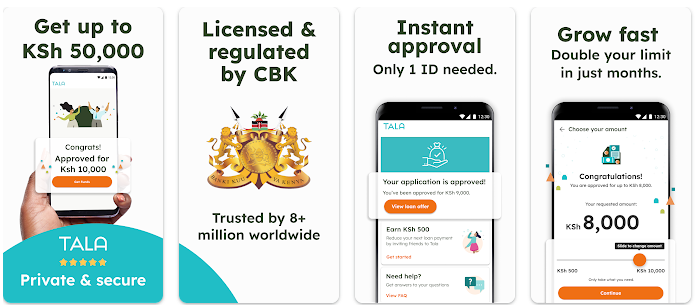

2.Tala (formerly Mkopo Rahisi):

Tala is a well-known micro-lending app that provides instant short-term loans to Kenyan users. Loan limits are determined by an individual’s credit score, which is calculated based on data from their smartphone.

Pros:

Quick and easy loan application process.

High loan approval rates.

No need for collateral.

Cons:

Interest rates can be relatively high.

The app collects a significant amount of personal data.

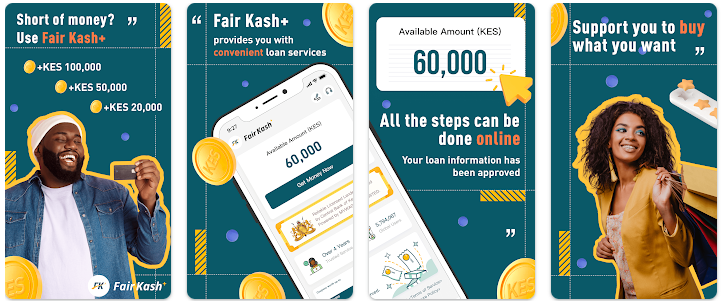

3.Fairkash+:

Fairkash+ is another popular mobile lending app in Kenya. It offers quick, unsecured loans with flexible repayment terms. Loan limits increase with on-time repayments and a good borrowing history.

Pros:

Quick loan disbursement.

Offers free financial education content.

Rewards borrowers for good repayment behavior.

Cons:

Interest rates can be relatively high.

Loan limits may start low for new users.

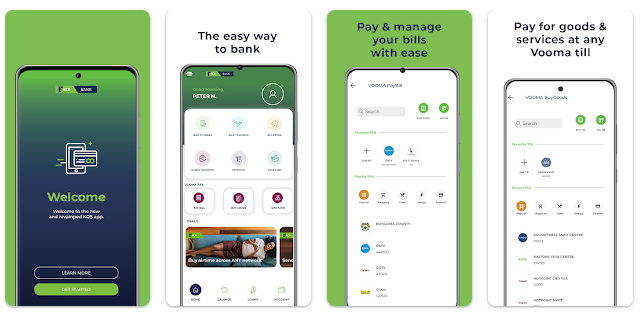

4.KCB M-Pesa:

KCB M-Pesa is a partnership between Kenya Commercial Bank (KCB) and Safaricom’s M-Pesa. The app allows users to access mobile loans, savings, and other financial services.

Pros:

Easy integration with M-Pesa.

Provides a savings account option.

Competitive interest rates.

Cons:

Users may need an active KCB M-Pesa account.

Loan limits can be low for new users.

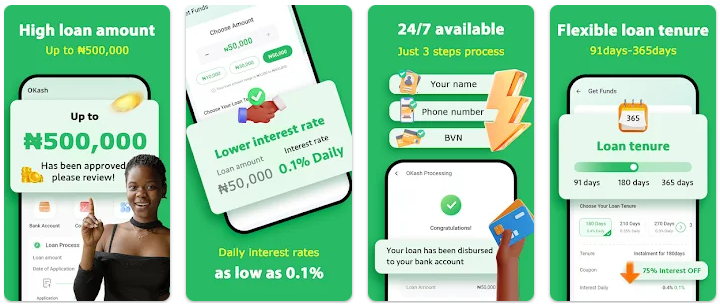

5.Okash:

Okash is a mobile lending app that targets low and middle-income earners in Kenya. It offers short-term loans to users to meet their financial needs.

Pros:

Transparent fee structure.

Provides free financial tips and budgeting advice.

Loan limits increase with responsible borrowing.

Cons:

Interest rates can be relatively high.

Loan limits may be limited for new users.

Please keep in mind that the lending landscape in Kenya is highly dynamic, and terms and conditions for these loan apps can change frequently. It’s crucial to carefully review the terms, interest rates, and fees associated with each app before borrowing, and ensure you can manage repayments on time to avoid high penalties. Additionally, consider looking for newer loan apps and reading the latest user reviews for the most current information.