If you have an urgent need for a small loan in Nigeria in 2023, several reputable loan apps can provide quick and convenient access to funds. Here are some of the best loan apps recommended in Nigeria for small loans:

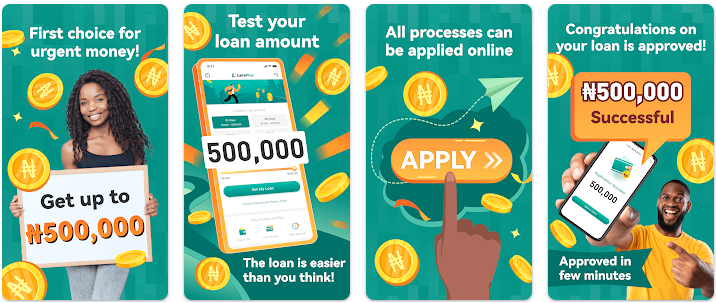

- LairaPlus:

- LairaPlus is a top choice for small loans in Nigeria. It offers a user-friendly interface, quick approval, and minimal documentation requirements. Borrowers can access small loans with competitive interest rates.

- LairaPlus is a top choice for small loans in Nigeria. It offers a user-friendly interface, quick approval, and minimal documentation requirements. Borrowers can access small loans with competitive interest rates.

- FairMoney:

- FairMoney is known for its fast and accessible loan services. It provides small loans with a straightforward application process and competitive interest rates. FairMoney aims to enhance financial inclusion in Nigeria.

- Carbon (formerly Paylater):

- Carbon is one of the pioneers in the Nigerian loan app industry. It offers small loans, payment solutions, and other financial services. The app is user-friendly and provides quick loan approvals.

- Branch:

- Branch offers small loans for personal and business needs. Its application process is simple and user-friendly. Borrowers can access loans quickly and build their credit history.

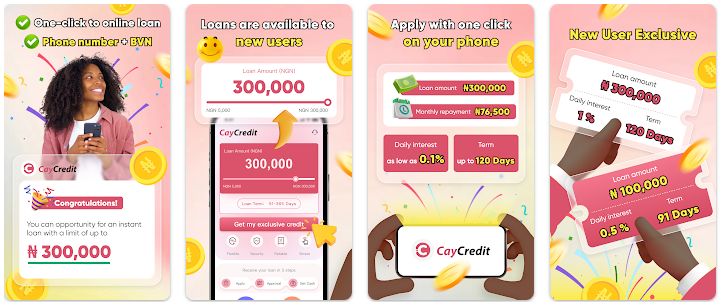

- CayCredit:

- CayCredit provides small loans along with other financial products. It offers flexibility in repayment and aims to promote financial literacy and inclusion.

- CayCredit provides small loans along with other financial products. It offers flexibility in repayment and aims to promote financial literacy and inclusion.

- Aella Credit:

- Aella Credit offers small loans to both individuals and employees of partner companies. The app is designed to meet the short-term financial needs of borrowers.

- QuickCheck:

- QuickCheck is known for its quick loan approval process. It offers small loans without collateral requirements and is committed to ensuring financial inclusion.

- Kuda Bank:

- Kuda Bank is a digital bank that offers a wide range of financial services, including small loans. The app is designed to simplify banking and financial transactions.

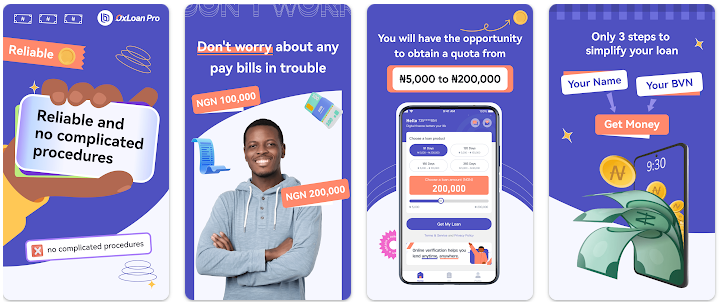

- Oxloan pro:

- Oxloan pro is a mobile wallet app that offers small loans to users. It combines financial services, such as loans and payments, in a single platform.

- Oxloan pro is a mobile wallet app that offers small loans to users. It combines financial services, such as loans and payments, in a single platform.

- BranchPay:

- BranchPay is a loan app that provides small loans to individuals and businesses. It offers competitive interest rates and convenient repayment options.

Please note that the availability of these loan apps may vary, and loan terms may change over time. When using any loan app, make sure to review the terms and conditions, understand the interest rates and fees, and borrow responsibly to meet your financial needs without overextending your finances. Additionally, always ensure the security of your personal and financial information when using loan apps.